montgomery al sales tax form

Beer Tax updated Dec. Forms Distribution Center 1-800-829-1040.

/cloudfront-us-east-1.images.arcpublishing.com/gray/FKDENEEJMVEZXF3RDDVZUZ5UOU.png)

New Tax Relief Laws Help Alabamians Save Money

Motor FuelGasolineOther Fuel Tax Form.

. Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7. This is the total of state county and city sales tax rates. Prepared application for salesuse tax registration options for getting.

2018 Gas Tax updated Dec. State Sales Tax Form information registration support. Ad Download Or Email DoR 2100 More Fillable Forms Register and Subscribe Now.

With local taxes the total sales tax rate is between 5000 and 11500. Taxpayer Bill of Rights. Alabama Department of Revenue Sales and Use Tax Division Room 4303 PO.

Information on city business licenses. The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax. Alabama has recent rate changes Thu Jul 01 2021.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. If you are currently setup to Electronically File State of Alabama SalesUse Taxes online step by step instructions for adding Montgomery County to your online filing through. Montgomery AL 36104 Phone.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. Moores mill al sales tax rate. File one form for each reporting period with the city of birminghamrevenue division and make a copy for your.

Montrose al sales tax rate. The county sales tax rate is. However pursuant to Section 40-23-7 Code of.

Access directory of city county and state tax rates for Sales Use Tax. Please remit the City of Hartselles local tax to. Ad Download Or Email DoR 2100 More Fillable Forms Register and Subscribe Now.

The minimum combined 2022 sales tax rate for Montgomery County Alabama is. The cost of a Montgomery Alabama Sales Tax Permit depends on a companys industry geographic service regions and possibly other factors. Box 327710 Montgomery AL 36132-7710 334-242-1490 phone 334-353-7867 fax.

This permit will furnish your business with a unique sales tax number. City of Montgomery This form combines sales and sellersconsumers use tax reporting. The state sales tax rate in Alabama is 4000.

Ad New State Sales Tax Registration. You can print a. Depending on local municipalities the total tax rate can be as high as 11.

Automate sales tax preparation and filing and get back to selling. What is the sales tax rate in Montgomery Alabama. The calculating functions will not work with the Google Chrome and Microsoft Edge built-in PDF reader.

Automate sales tax preparation and filing and get back to selling. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Montgomery County Alabama Sellers UseSales Tax Consumers Use Tax MAIL RETURN WITH REMITTANCE TO.

Montgomery AL 36130 334 242-0400. THIS FORM SHOULD BE RETURNED IN ITS ENTIRETY Please read definitions on back prior to. 1enclosed are enough sellers use tax forms for the entire calendar year.

334-625-2994 Hours 730 am. The Alabama state sales tax rate is currently. Alabama Department of Revenue Sales and Use Tax Division Post Office Box 327710 Montgomery Alabama 36132-7710 334-242-1490 or 866.

Moores mill al sales tax rate. SalesSellers UseConsumers Use Tax Form. Notice Fillable PDF forms require Adobe Acrobat Reader.

Spear Montgomery County Revenue Commissioner PO. There is no applicable special tax. Learn more State sales tax rates.

The minimum combined 2022 sales tax rate for Montgomery Alabama is. Register for an Alabama Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. This is the total of state and county sales tax rates.

To schedule an appointment at our main office in Montgomery Alabama click here. Alabama has a 4 statewide sales tax rate but also has 284 local tax. The Montgomery Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Montgomery local sales taxesThe local sales tax consists of a 250 county sales tax.

At LicenseSuite we offer affordable. Fillable PDF forms require Adobe Acrobat Reader. A Montgomery Alabama Sales Tax Permit can only be obtained through an authorized government agency.

Located outside Alabama that have no inventory for sale in Alabama.

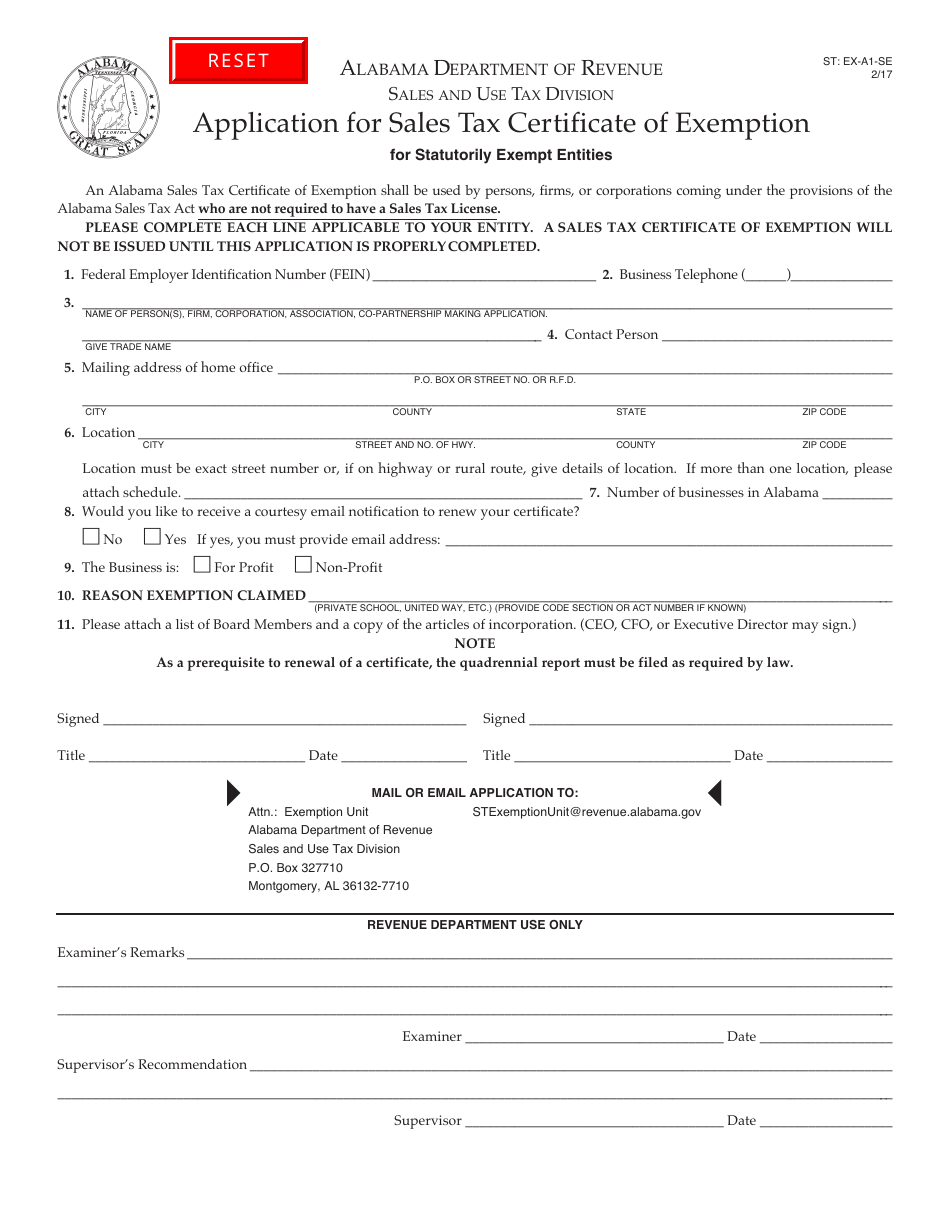

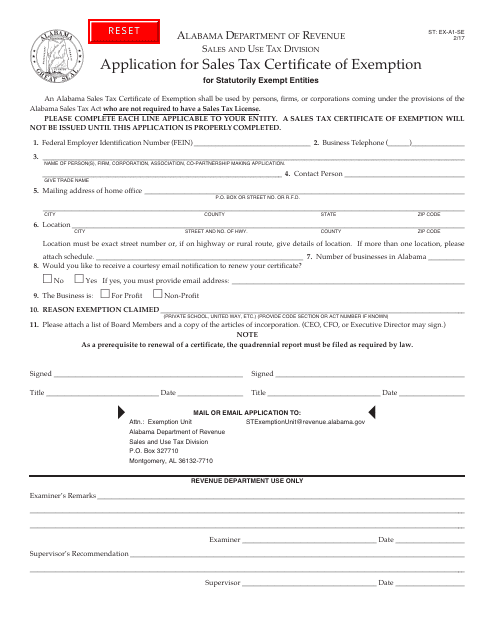

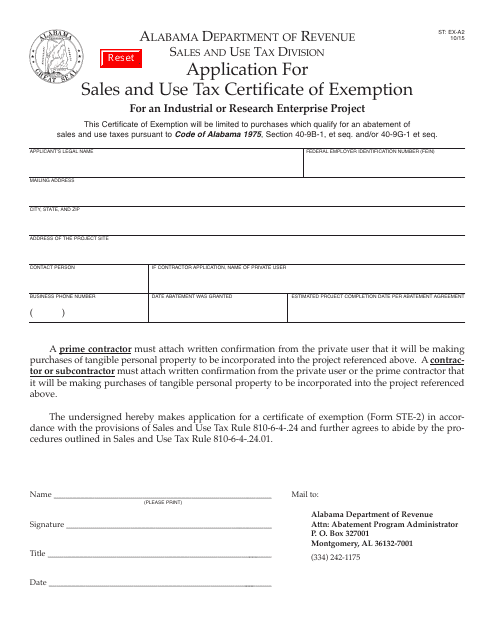

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Fill Free Fillable Forms State Of Alabama

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

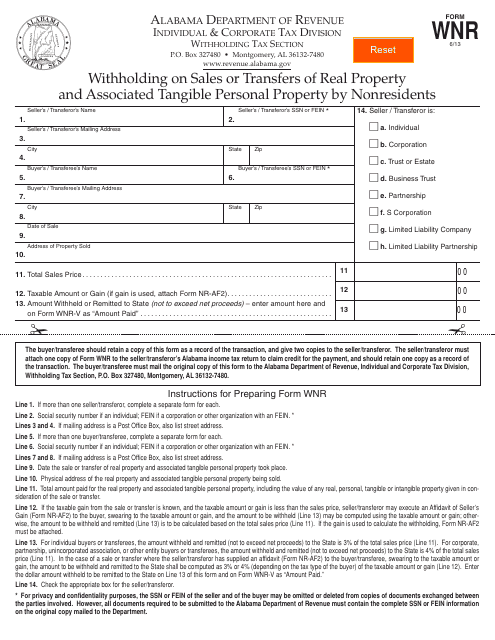

Form Wnr Download Fillable Pdf Or Fill Online Withholding Sales Or Transfers Of Real Property And Associated Tangible Personal Property By Nonresidents Alabama Templateroller

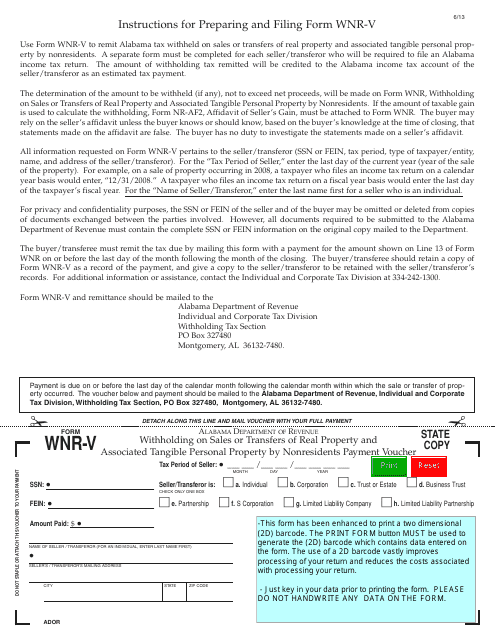

Form Wnr V Download Fillable Pdf Or Fill Online Withholding On Sales Or Transfers Of Real Property And Associated Tangible Personal Property By Nonresidents Payment Voucher Alabama Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/FKDENEEJMVEZXF3RDDVZUZ5UOU.png)

New Tax Relief Laws Help Alabamians Save Money

Form St Ex A2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller

Fill Free Fillable Forms State Of Alabama

Ahs Tax Exemption Letter Diamedical Usa

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

25 000 Alabamians Owed Average Of 800 From Irs Here S Who Is Eligible Al Com

Townhomes With Rear Entry Garage Townhouse House Styles Towns

/cloudfront-us-east-1.images.arcpublishing.com/gray/FKDENEEJMVEZXF3RDDVZUZ5UOU.png)

New Tax Relief Laws Help Alabamians Save Money

Loloi Hygge Yg 03 Oatmeal Ivory Area Rug Hygge Country House Decor Scandinavian Textiles

Bmx Plus 101 Freestyle Tricks Vhs Advertisement Circa 1986 87 Bmx Bicycle Bmx Freestyle Bmx Flatland